The Definitive Guide for Real Estate Taxes Florida

Table of ContentsSee This Report about Real Estate Taxes FloridaFacts About Real Estate Taxes Florida UncoveredWhat Does Real Estate Taxes Florida Do?The Definitive Guide for Real Estate Taxes Florida6 Simple Techniques For Real Estate Taxes FloridaThe 30-Second Trick For Real Estate Taxes FloridaThe Best Guide To Real Estate Taxes Florida

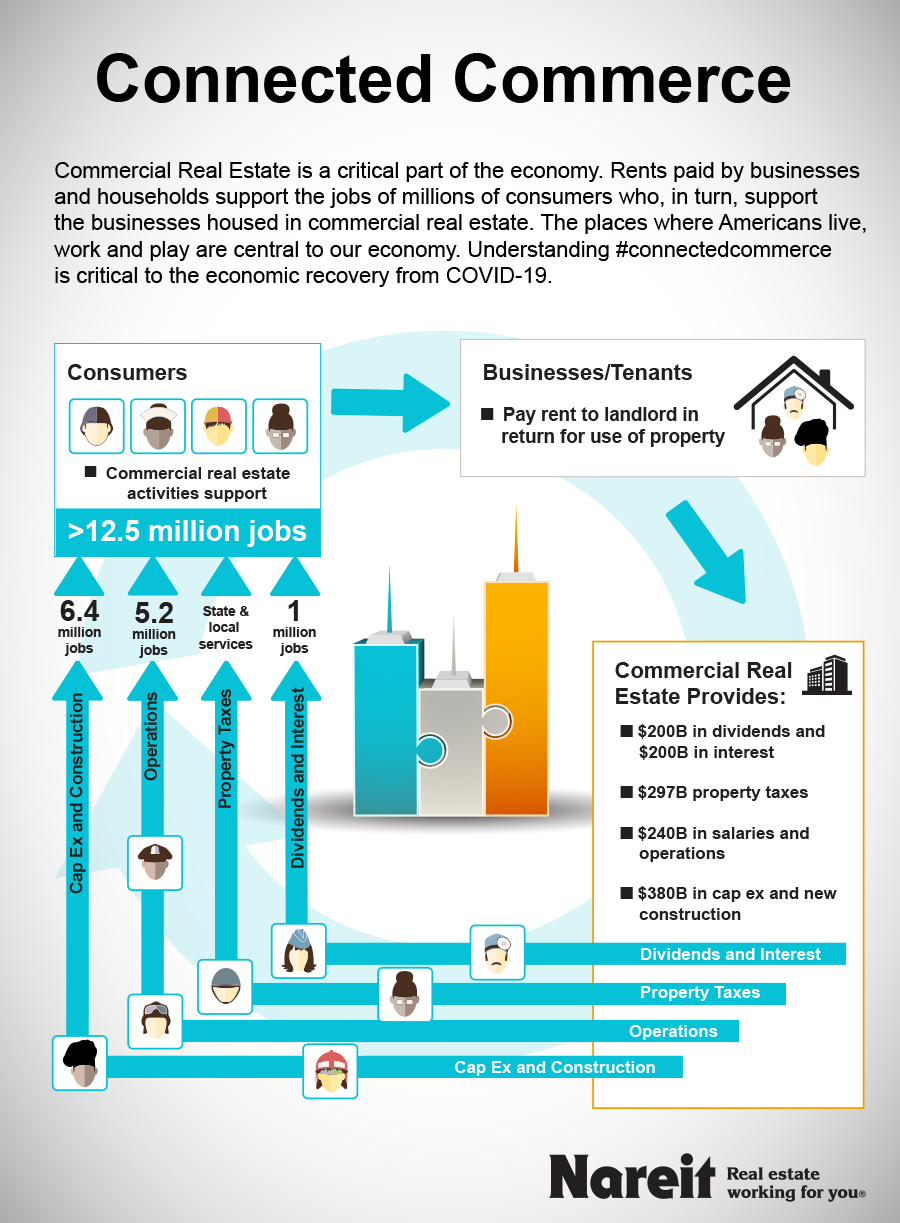

Real estate tax are the financial backbone of local federal governments. They account for virtually three-quarters of neighborhood taxation as well as are a considerable regional profits resource for funding K12 education and learning, police and fire divisions, parks, and also other solutions. Real estate tax likewise shape regional housing markets by influencing the costs of buying, renting, or purchasing homes and also apartment buildings.Property taxes are a very vital component of homeownership. Federal governments examine building tax obligations based on location as well as worth.

Below is a chart with census information from 2017, that shows residential or commercial property taxes and how much they make up the percentage of state revenues. We can see which specifies depend extra on home tax obligations than others. Alabama, Delaware, New Mexico, Hawaii, Arkansas are the top 5 states with the most affordable percent to earnings.

Real Estate Taxes Florida for Dummies

These certificates are bid on, either by quote down public auction where the rate of interest rate is decreased per bid or a premium bid or bid up where the victor is the greatest bidder. People that want to spend their money have actually paid for the certification because the rate of interest troubled the unsettled tax is currently obtained by the financier as opposed to the city government.

The Only Guide to Real Estate Taxes Florida

Those who wish to confiscate will certainly require to also generate a deed application that carries a cost as low as $39 yet can be approximately $875 in some states however differs per state. If the repossession process is complete after that the financier would have the ability to get a building free and clear simply for the fees paid in tax obligations which would be a fantastic investment.

The lesson for home owners: see to it you maintain existing on your home tax payments due to the high rates of interest that build up when the state offers your tax lien. real estate taxes florida. As a home owner it is necessary to be watchful in paying your residential property tax obligations to care for your property as well as prevent try this website paying much more in passion on overdue tax obligations.

Real Estate Taxes Florida Things To Know Before You Buy

Residential property tax obligation is a tax paid on residential or commercial property had by a specific or various other lawful entity, such as a firm. It is calculated by a regional federal government where the residential property is situated and also paid by the owner of the property.

Several territories additionally tax obligation concrete personal residential property, such as vehicles and boats. The regional regulating body will certainly utilize the analyzed tax obligations to fund water and drain enhancements, as well as give police, fire defense, education, road and freeway building and construction, libraries, as well as other solutions that benefit the community. Acts of reconveyance do not connect with building taxes.

Real estate tax is based upon the value of the property, which can be realty orin lots of jurisdictionsalso concrete individual property. Improvements in water and sewage system use the assessed taxes. Real estate tax rates and the kinds of residential properties strained differ by jurisdiction. When purchasing a property, it is essential to scrutinize the applicable tax obligation laws.

Real Estate Taxes Florida Things To Know Before You Buy

The price in the United States is considerably higher than in lots of European nations. Several empiricists and also pundits have required a boost in building tax obligation prices in developed economies. They suggest that the predictability as well as market-correcting personality of the tax urges both security and also correct growth of the real estate.

In some locations, the tax obligation assessor might be a chosen authorities. The assessor will designate real estate tax to owners based on existing fair market price. This value becomes the evaluated value for the home. The payment timetable of residential or commercial property taxes varies by region. In mostly all regional building tax obligation codes, there are devices through which the proprietor can discuss their tax obligation price page with the assessor or officially oppose the rate.

Customers must constantly complete a complete evaluation of exceptional liens prior to buying any residential or commercial property. Individuals usually utilize the terms residential or commercial property tax obligation as well as real estate tax obligation mutually. And also it's partially real: Real estate tax obligation is a home tax obligation. That's not real the various other method around. Not all residential property taxes are real estate tax obligations.

How Real Estate Taxes Florida can Save You Time, Stress, and Money.

So below's the distinction: Property tax are tax obligations on real estate only; property taxes can consist of both real estate and also tangible personal property.

When a building is currently being leased out, it produces a stream of regular monthly rent repayments. Some homes might have added repayments related Website to them, such as for washing machines and clothes dryers, storage space, as well as auto parking. Relying on the balancing out cash money outflows for home loan repayments, real estate tax, maintenance, as well as so forth, the web cash inflows may be substantial.

Presently, the devaluation duration for household realty is 27 years, while the depreciation duration for industrial buildings is 39 years. Depending on the location, actual estate has a tendency to appreciate relying on neighborhood need levels. This can differ considerably within also a brief distance, yet if you select building meticulously, it can value fairly substantially over an extended period of time.

All About Real Estate Taxes Florida

This has traditionally not been the instance for real estate, which often tends to appreciate at a rate much faster than inflation. Part of the reason for this is that financiers see genuine estate as a hedge against rising cost of living, and so are much more likely to bid up its cost when rising cost of living is high.